Vogue College of Cosmetology

Disclosures

Student Forms and Information

Disclosures:

Fredericksburg Rd, San Antonio, Texas

Net Price Calculator

Fredericksburg Road Campus NCES Stats

Fredericksburg Road College Navigator

Ingram Rd, San Antonio, Texas

Net Price Calculator

Ingram Road Campus NCES Stats

Ingram Road College Navigator

McAllen, Texas

Net Price Calculator

McAllen Campus NCES Stats

McAllen College Navigator

Lubbock, Texas

Net Price Calculator

Lubbock Campus NCES Stats

Lubbock College Navigator

Santa Fe, New Mexico

Net Price Calculator

Santa Fe Campus NCES Stats

Santa Fe College Navigator

Student Right To Know Information:

Student Catalog Santa Fe

Student Catalog Texas

Texas and New Mexico Consumer Catalog

Title IX Information

Financial Aid Disclosures

NM Alcohol and Other Drug Abuse Notification

TX Alcohol and Other Drug Abuse Notification

Biennial Alcohol and Other Drug Abuse Program Review

Campus Annual Security Reports:

Fredericksburg Road Campus

Campus Security Fredericksburg 2019

Ingram Road Campus

McAllen Campus

Santa Fe Campus

Lubbock Campus

Student Forms

Student Grievance Policy and Form

Student Request for Accommodation

Please contact a Vogue College Admissions Representative at (866) 227-3779 if you have any questions regarding admissions criteria!

Financial Aid Information

To receive Title IV, HEA funds, a student must be qualified to study at the postsecondary level. A student qualifies if s/he:

- has a high school diploma (this can be from a foreign school if it is equivalent to a U.S. high school diploma);

- has the recognized equivalent of a high school diploma, such as a general educational development (GED) certificate or other state sanctioned test or diploma-equivalency certificate;

- has completed homeschooling at the secondary level as defined by state law;

- has completed secondary school education in a homeschool setting which qualifies for an exemption from compulsory attendance requirements under state law, if state law does not require a homeschooled student to receive a credential for their education; or

- has completed one of the ability-to-benefit (ATB) alternatives and is either currently enrolled in an eligible career pathway program or first enrolled in an eligible postsecondary program prior to July 1, 2012.

- Note: As part of Vogue Colleges General Admissions requirements, the institution does not accept ATB students at this time.

Recognized equivalents of a high school diploma

The Department recognizes several equivalents to a high school diploma:- a GED certificate;

- a certificate or other official completion documentation demonstrating that the student has passed a state-authorized examination (such as the Test Assessing Secondary Completion (TASC) the High School Equivalency Test (HiSET), or, in California, the California High School Proficiency Exam) that the state recognizes as the equivalent of a high school diploma (certificates of attendance and/or completion are not included in this qualifying category);

- An associate’s degree.

Note: merely possessing a certificate of attendance and/or high-school completion is not sufficient for a student to be eligible for Title IV, HEA funding. Such a certificate may be issued without a student having completed all of the academic graduation requirements, including passing any required examinations. A state must consider a certificate or high-school-completion-equivalency test as equivalent to a high school diploma in that state in order for it to be considered equivalent to a high school diploma for Title IV, HEA aid eligibility purposes.

Note: A student may self-certify on the FAFSA that he/she has received a high school diploma or high school equivalency certificate or that he has completed secondary school through homeschooling as defined by state law. If a student indicates that he has a diploma or high school equivalency certificate, Vogue is not required to ask for a copy (except as noted below), but if Vogue requires a diploma for admission, then we must rely on the copy of the diploma or high school equivalency certificate and not on the student’s certification alone.

When a student incorrectly states their diploma status, for example, stating one year that they had a high school diploma, and in a subsequent year either notifying the institution that the previous submission was a mistake, or simply answering “no” to the question of whether or not they have a high school diploma, then the student is ineligible for all Title IV, HEA aid, and is ineligible for all Tittle IV, HEA aid going forward, and must also return the aid they previously received when ineligible, even if it was for an award year which has been completed.

In addition to meeting the Title IV, HEA Funds Academic Requirements for eligibility, students must also:

- Be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program.

- Be registered with Selective Service, if you are a male (you must register between the ages of 18 and 25). Men exempted from the requirement to register include;

- Males currently in the armed services and on active duty (this exception does not apply to members of the Reserve and National Guard who are not on active duty);

- Males who are not yet 18 at the time that they complete their application (an update is not required during the year, even if a student turns 18 after completing the application);

- Males born before 1960;

- Citizens of the Republic of Palau, the Republic of the Marshall Islands, or the Federated States of Micronesia*;

- Noncitizens that first entered the U.S. as lawful non-immigrants on a valid visa and remained in the U.S. on the terms of that visa until after they turned 26.

- Have a valid Social Security number unless you are from the Republic of the Marshall Islands, Federated States of Micronesia, or the Republic of Palau.

- Completed a FAFSA and the school must have a current ISIR to start the initial eligibility process.

- Sign certifying statements on the FAFSA stating that:

- you are not in default on a federal student loans

- do not owe a refund on a federal grant

- Sign the required statement that you will use federal student aid only for educational purposes

- Maintain satisfactory academic progress (SAP) while you are attending college or a career school.

- Be enrolled at least halftime to receive assistance from the Direct Loan Program.

- The Pell Grant program does not require half time enrollment, but the student enrollment status does affect the amount of Pell a student may receive. A student may receive Pell for a total of 12 payment periods or 600%. Once the student has reached this limit, no further Pell may be received.

- For the purposes of the Federal Pell Grant Program, students must not be incarcerated in a Federal or State penal institution

- For the purpose of the Federal Pell Grant Program, student does not have a baccalaureate or first professional degree

- The student has not obtained loan amounts that exceed annual or aggregate loan limits made under any title IV, HEA loan program;

- student does not have property subject to a judgment lien for a debt owed to the United States; and • Is not liable for a grant or Federal Perkins loan overpayment. (A student receives a grant or Federal Perkins loan overpayment if the student received grant or Federal Perkins loan payments that exceeded the amount he or she was eligible to receive; or if the student withdraws, that exceeded the amount he or she was entitled to receive for non-institutional charges.)

In addition, students must meet citizenship requirements as follows:

- Be a citizen or national of the United States; or

- Provide evidence from the U.S. Immigration and Naturalization Service that he or she Is a permanent resident of the United States; or Is in the United States for other than a temporary purpose with the intention of becoming a citizen or permanent resident;

- A citizen of the Federated States of Micronesia, Republic of the Marshall Islands, or the Republic of Palau is eligible to receive funds under the FWS, FSEOG, and Federal Pell Grant programs if the student attends an eligible institution in a State, or a public or nonprofit private eligible institution of higher education in those jurisdictions.

If a student asserts that he or she is a citizen of the United States on the Free Application for Federal Student Aid (FAFSA), the Secretary attempts to confirm that assertion under a data match with the Social Security Administration. If the Social Security Administration confirms the student’s citizenship, the Secretary reports that confirmation to the institution and the student.

If the Social Security Administration does not confirm the student’s citizenship assertion under the data match with the Secretary, the student can establish U.S. citizenship by submitting documentary evidence of that status to the institution. Before denying title IV, HEA assistance to a student for failing to establish citizenship, an institution must give a student at least 30 days notice to produce evidence of U.S. citizenship.

If the student falls in one of the categories below, they are generally considered an “eligible noncitizen.”

- A permanent U.S. resident with a Permanent Resident Card (I-551);

- A conditional permanent resident with a Conditional Green Card (I-551C);

- The holder of an Arrival-Departure Record (I-94) from the Department of Homeland Security showing any one of the following designations: “Refugee,” “Asylum Granted,” “Parolee” (I-94 confirms that you were paroled for a minimum of one year and status has not expired), T-Visa holder (T-1, T-2, T-3, etc.) or “Cuban-Haitian Entrant;” or

- The holder of a valid certification or eligibility letter from the Department of Health and Human Services showing a designation of “Victim of human trafficking.”

If the student is in the U.S. and have been granted Deferred Action for Childhood Arrivals (DACA), an F1 or F2 student visa, a J1 or J2 exchange visitor visa, or a G series visa (pertaining to international organizations), the student must select “No, I am not a citizen or eligible noncitizen.” The student will not be eligible for federal student aid. If the student has a Social Security Number but is not a citizen or an eligible noncitizen, including if the student has been granted DACA, the student should still complete the FAFSA because s/he may be eligible for state or college aid.

Other Funding Sources

Selected programs of study at Vogue College are approved by the U.S. Department of Veterans Affairs for enrollment of those eligible to receive Chapters 31, Chapter 33, and Chapter 35 benefits.

Institutional financing is available to students who choose to make monthly payments towards their tuition balance instead of paying up front. Vogue College does not charge interest on institutional financing payments that are made on time. Institutional financial plans are determined by the financial aid department.

Vogue College offers limited scholarships to qualified applicants. To determine an applicant’s eligibility for a partial scholarship, he/she must complete an Application and provide any other information requested. For more detailed information please see Scholarship Policy. Vogue College has 5 days to process the scholarship application. Federal Title IV aid will be recalculated and the need adjusted for all scholarship recipients.

i. A student is considered to be incarcerated if she/he is serving a criminal sentence in a federal, state, or local penitentiary, prison, jail, reformatory, work farm, or similar correctional institution (whether it is operated by the government or a contractor).

ii. A student is not considered to be incarcerated if she/he is in a halfway house or home detention or is sentenced to serve only weekends. Our attendance policy specifies that all classed and practical studies are done at the school’s physical location; therefore, incarcerated students are not eligible for admissions.

- A federal or state drug conviction (but not a local or municipal conviction) can disqualify a student for FSA funds. The student self-certifies in applying for aid that he is eligible; you’re not required to confirm this unless you have conflicting information.

- The Institution is not required to confirm this unless there is evidence of conflicting information.

- The chart below illustrates the period of ineligibility for FSA funds, depending on whether the conviction was for sale or possession and whether the student had previous offenses. A conviction for sale of drugs includes convictions for conspiring to sell drugs.

Possession of illegal drugs Sale of illegal drug 1st Offense 1 year from date of conviction 2 years from date of conviction 2nd Offense 2 years from date of conviction Indefinite period 1st Offense Indefinite period Indefinite period - If the student was convicted of both possessing and selling illegal drugs, and the periods of ineligibility are different, the student will be ineligible for the longer period. Schools must provide each student who becomes ineligible for FSA funds due to a drug conviction a clear and conspicuous written notice of his loss of eligibility and the methods whereby s/he can become eligible again.

- A student regains eligibility the day after the period of ineligibility ends (i.e., for a 1st or 2nd offense); or when he or she successfully completes a qualified drug rehabilitation program that includes passing two unannounced drug tests given by such a program. Further drug convictions will make him ineligible again.

- Additional guidance can be found in the current FSA Hand book, Volume 1, Chapter 1, for Student eligibility.

Every year a number of students who are eligible for financial aid are randomly selected for verification by the U.S. Department of Education by the FAFSA Central Processing System (CPS). If a student is selected for federal verification, they will be asked to complete a Verification Worksheet (provided by the Office of Student Financial Planning) and must provide additional information before financial aid can be disbursed to the student account. This documentation may include but is not limited to federal income tax transcript and W-2 forms (student’s, spouse and/or parents/guardians), proof of untaxed income, housing allowances, etc. Students will be notified in writing of all documents required to fulfill this federal requirement and what their verification code (V1 – V6) was so they can complete the required verification requirement. If after review by the Office of Student Financial Planning, there are any changes to the financial aid package the student will be notified in writing. The verification procedures will be conducted as follows:

- When selected by CPS for the process of verification, the student must submit all required documentation to the finance office within 14 days from the date the student is notified that the additional documentation is needed for this process.

- If the student does not provide all of the required documentation within the 14 day time frame, the student will be required to make other payment arrangements until the documentation is received and the student’s eligibility for federal student aid has been established.

- The finance office reserves the right to make exceptions to the policy stated above on a case by case basis for extenuating circumstances.

- The finance office will notify the student of any changes to their financial aid award resulting from corrections made due to the verification process. An adjustment will be made to the student’s financial aid award as required by federal regulations and an addendum to the existing award letter or a new award letter will be issued.

Dependency Override – Students who do not meet the Federal definition of an independent, but have unusual circumstances, may appeal their dependency status to The Academy’s Financial Aid Office. Dependency Status overrides are done on a case by case basis and a determination from one Financial Aid Administrator at one institution is not binding at another institution.

Successful appeals may result in an increase in the student’s eligibility for aid. The Application and Verification Guide (AVG) has identified four conditions that individually or in combination with one another, do not qualify as “unusual circumstances” or that do not merit a dependency override. These circumstances are as follows:

- Parents refusing to contribute to the student’s education

- Parents unwilling to provide information on the application or for verification

- Parents are not claiming the students as a dependent for income tax purposes

- Student demonstrates total self-sufficiency.

Students with special circumstances should contact The Academy’s Financial Aid Office. Those students whose appeals are determined eligible will be required to submit three letters detailing the student’s situation. The first letter must be from the student detailing their situation and the other two letters must be from outside sources familiar with the student’s situation (i.e.: Clergy, family friend, counsellor, etc.)

Professional Judgement – Circumstances beyond the student’s control (and/or family) that affect the student’s (and/or family) income during the current academic year could result in a reduced estimated family contribution (EFC). Students with special circumstances should always complete a FAFSA and then contact the Financial Aid office. If a student wishes to appeal the EFC based on special circumstances and is determined eligible to do so, the student should complete a Professional Judgement form and may be requested to supply supporting documentation of said circumstances.

Vogue College complies with the Americans with Disabilities Act of 1990 and is wheelchair accessible. The school will provide reasonable modifications and/or accommodations for students with disabilities depending on the student’s need.

It is the responsibility of a person with disabilities to seek available assistance and make their needs known at the time of enrollment. Information pertaining to an Applicant’s disability is voluntary and confidential. If you are interested in attending Vogue College but are in need of reasonable accommodations, you should schedule an appointment with the Director. At this meeting, nature of the reported disability and its impact on learning will be discussed. The process of receiving reasonable accommodations at Vogue College, and the types of accommodations available will also be discussed.

Please bring copies of current documentation of a disability to this meeting. Documentation must be provided by a medical expert within the last three years and include:

- a diagnosis of the disability;

- how the diagnosis was determined (what tests were given and the results); and

- A clinical summary, which includes an assessment of how the disability will impact the individual in a college environment and what accommodations are recommended.

Upon completion of the initial meeting, a formal request for the accommodation must be submitted in writing to the school. The school will respond to the request within 15 days of receipt. During this 15-day time frame, the school will consult with Texas Department of Licensing and Regulation or New Mexico Licensing and Regulation Department in order to ensure the accommodation will be granted during the state board-licensing exam. The initial meeting, formal request, and response from the school must take place prior to the pre-enrollment process.

Note: In order to be eligible for Title IV funding, the student must be able to benefit from the reasonable accommodations and be able to take the state board-licensing exam.

Disclosure Requirement: Made available through appropriate publications, mailings, or electronic media.

Each institution must make available to prospective and enrolled students information regarding how and where to contact individuals designated to assist enrolled or prospective students in obtaining the institutional, financial aid, security policies, graduation and completion rates, and crime statistics information required to be disclosed under HEA Sec. 485(a). This information is posted on Vogue College’s website at https://www.vogue.edu/disclosures/ and can be found in the student catalog. Paper copies are available upon request.

For general financial aid information contact your campus financial aid officer.

Ingram Campus

Nelcy Amy

210-432-5904

Fredericksburg Rd Campus

Sylvia Perez

210-732-9401

McAllen Campus

Susana Gonzales

956-687-6149

Lubbock Campus

Christin Delarosa

805-589-5150

Santa Fe Campus

Monica Hernandez

505-473-5552

For Security policies, crime statistics, graduation or completion rates or related information contact:

Name: Monica Hernandez, Assistant Director of Financial Aid and Compliance

Office hours: 9:00 AM-5:00 PM, Monday-Friday

Phone number: 512-916-0077

Email: [email protected]

Financial Assistance is available to those who qualify through the Financial Aid Office. The Financial Aid Officer for your campus is listed above.

Department of Education publication “Funding Your Education” is available in the Financial Aid Office in English and Spanish, and is posted on our website under the financial aid tab.

Vogue College does not provide Campus-based aid programs.

Vogue College will work with local and State funding agencies and groups. Determinations are made directly through those agencies or groups.

Vogue College works with the Veterans Affair office and Title IV Federal Student Aid Programs. Funding determinations are made directly through those agencies.

Students must be enrolled at least half time to receive assistance from the Federal Student Loan Programs (Pell Grant and Direct Loans). Students must certify they have not defaulted on a previous Title IV loan, have not exceeded the annual and/or aggregate loan limits and does not have property subject to judgment lien for a debt owed to the United States and is not liable for a Grant of Federal Perkins Loan overpayment.

Pell awards are prorated based on attendance.

Effective July 1, 2012 Ability-to-Benefit Students will not be eligible for Title IV Federal Financial Aid. Students enrolled in approved programs of study prior to July 1, 2012 will be grandfathered and remain Title IV eligible.

More information may be found by accessing the websites below.

Title IV Pell Grants: https://studentaid.ed.gov/sa/types/grants-scholarships

Direct Loans: https://studentaid.ed.gov/sa/types/loans

Parent Plus Loans: https://studentaid.ed.gov/sa/types/loans/plus

| Loan Type | Borrower Type | Loans first disbursed on or after 7/1/16 and before 7/1/17 |

| Direct Subsidized Loans | Undergraduate | 3.76% |

| Direct Unsubsidized Loans | Undergraduate | 3.76% |

Loan Fees for Direct Subsidized Loans and Direct Unsubsidized Loans

| First Disbursement Date | Loan Fee |

| On or after Oct. 1, 2015, and before Oct. 1, 2016 | 1.068% |

| On or after Oct. 1, 2016, and before Oct. 1, 2017 | 1.069% |

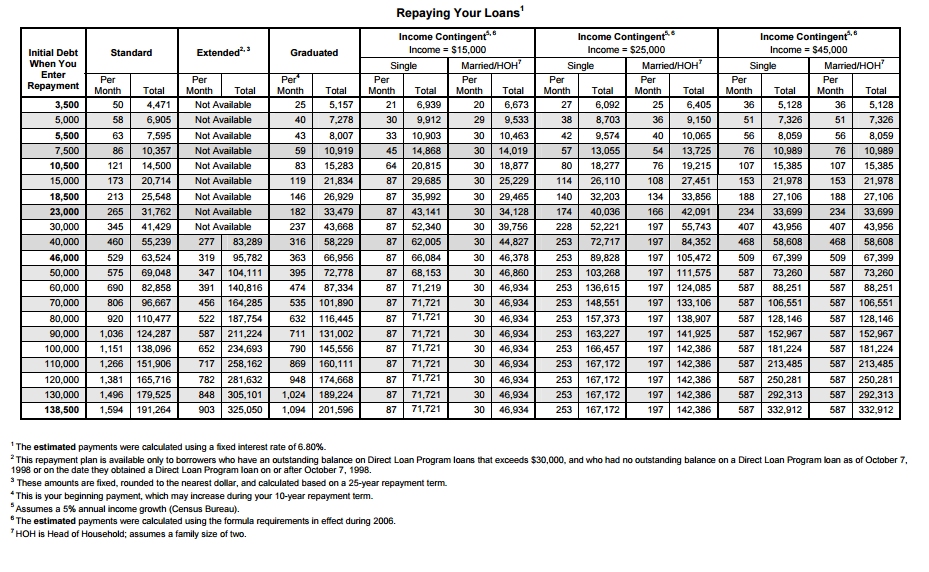

Repayment for Federal Direct Subsidized and Unsubsidized Loans

- Repayment on a Federal Direct loan begins after the student’s 6 month grace period has expired. The grace period begins when a student graduates, withdraws, or drops below half-time enrollment during an academic term.

- Interest on Federal Direct Subsidized loans begins to accrue after the 6 month grace period. Note: Federal Direct Subsidized loans disbursed between July 1, 2012 to June 30, 2014 are ineligible for the interest subsidy during the grace period. Students are responsible for the interest. If students choose not to pay the interest that accrues during the grace period, the interest will be added to the principal balance of the loan.

- Choose a payment plan that best fits your needs when you enter repayment.

Federal Student Disclosure Requirements Regulations set forth by the U.S. Dept. of Education require the disclosure of financial assistance and institutional information to students under Title IV of the Higher Education Act of 1965. These programs include the Federal Pell Grant Program, the campus-based programs (Federal Perkins Loan, Federal WorkStudy (FWS), and Federal Supplemental Educational Opportunity Grant (FSEOG) programs), the William D. Ford Federal Direct Loan (Direct Loan) Program, and the Federal Family Education Loan (FFEL) Program. Under the regulations, Vogue College of Cosmetology will notify enrolled students of the Title IV programs available to them. STUDENT FINANCIAL ASSISTANCE AVAILABLE The following student financial assistance is available at Vogue College of Cosmetology for those who qualify:

- Federal Direct Stafford Loans

- Federal Direct Parent PLUS loans

- Federal Pell Grant

Federal Pell Grants Pell Grants are disbursed in two payments per award year. The first disbursement generally occurs during the first week of enrollment, and the second disbursement occurs after the students complete the halfway point of their academic year. This is typically 450 clock hours for the Cosmetology program, 375 for the Esthetics and Instructor programs, and 300 for the Nail Technology program, provided the student is maintaining Satisfactory Academic Progress. A full-time Cosmetology student attending 34 hours per week, for example, will need to complete a minimum of 13 weeks and 450 clock hours before receiving payment period 2 funds. A part-time Esthetics student attending 24 hours per week will need to complete a minimum of 16 weeks and 375 hours. Pell awards are prorated based on clock hours and COA.

- Federal Direct Stafford Loans Stafford Loans are also disbursed in two payments per award year. The first disbursement takes place after 30 calendar days after enrollment*, and the second disbursement occurs after the student completes the halfway point of their academic year. This is also generally at 450 clock hours for the Cosmetology program, 375 for the Esthetics and Instructor programs and 300 clock hours for the Nail Tech program, provided the student is maintaining Satisfactory Academic Progress. Hours and weeks must be met prior to disbursement.

- Federal Direct Parent Loan (PLUS) The Parent PLUS Loan is disbursed in two payments per academic year as well. The first disbursement takes place after 30 calendar days of enrollment*, and the second disbursement occurs after the student completes the hallway point of their academic year, both hours and weeks, provided the student is maintaining Satisfactory Academic Progress. *Vogue College may make first disbursement prior to 30 calendar days of enrollment if the student is not a first year, first time borrower, and has a current federal student loan balance. Students who borrow a Stafford Direct Loan while attending Vogue College must complete the Direct Loan Entrance Counseling and an electronic master promissory note before funds will be certified.

Need Based Aid (Pell Grant and Stafford Subsidized Loan) Calculation:

COA (Cost of Attendance) – EFC (Expected Family Contribution) = Need Eligibility

Non-Need Based Aid (Unsubsidized Stafford and Parent PLUS Loan) Calculation:

COA – EFA (Expected Financial Assistance/all other aid) = Non-Need Eligibility

COA = Budget – each Student receiving an Award Letter estimating Title IV Eligibility will be assigned a Budget. The COA includes the following items: Tuition & Fees, Room and Board, Transportation, Misc/Personal, Books/Supplies and Other items such as special circumstances or expenses related to disabilities.

Institutional Financing is offered by Vogue but we do not have preferred lender arrangements. A Private Education Loan Application Self-Certification must be completed if the Student seeks an outside loan.

Vogue College does not employ any Students who are currently receiving financial aid and are attending Vogue College programs.

All Students who borrow a Stafford Loan while attending Vogue College must complete Direct Loan Entrance Counseling before funds will be certified.

For Federal Aid recipients, the Student’s payment period is suspended during the LOA and no federal financial aid will be disbursed to Students while on a LOA. Upon the Student’s return, the Student will resume the same payment period and coursework and will not be eligible for additional Title IV aid until the payment period has been completed. If the Student is a Title IV loan recipient, the Student will be informed of the effects that the Student’s failure to return from a leave may have on the Student’s loan repayment terms, including the expiration of the Student’s grace period.

This policy applies to students’ who withdraw official, unofficially or fail to return from a leave of absence or dismissed from enrollment at Vogue College. This policy is separate and distinct from the Vogue College refund policy. (See Institutional Refund Policy)

The calculated amount of the Return of Title IV, HEA (R2T4) funds that are required for the students affected by this policy, are determined according to the following definitions and procedures as prescribed by regulations.

The amount of Title IV, HEA aid earned is based on the amount of time a student spent in academic attendance, and the total aid received; it has no relationship to student’s incurred institutional charges. Because these requirements deal only with Title IV, HEA funds, the order of return of unearned funds do not include funds from sources other than the Title IV, HEA programs.

Title IV, HEA funds are awarded to the student under the assumption that he/she will attend school for the entire period for which the aid is awarded. When student withdraws, he/she may no longer be eligible for the full amount of Title IV, HEA funds that were originally scheduled to be received. Therefore, the amount of Federal funds earned must be determined. If the amount disbursed is greater than the amount earned, unearned funds must be returned.

The institution has 45 days from the date that the institution determines that the student withdrew to return all unearned funds for which it is responsible. Vogue College is required to notify the student if they owe a repayment via written notice.

Vogue College must advise the student or parent that they have 14 calendar days from the date that Vogue College sent the notification to accept a post withdraw disbursement. If a response is not received from the student or parent within the allowed time frame or the student declines the funds, Vogue College will return any earned funds that they are holding to the Title IV, HEA programs.

A student is “Officially” withdrawn on the date the student notifies the Financial Aid Director or School Director in writing of their intent to withdraw. The date of the termination for return and refund purposes will be the earliest of the following for official withdrawal:

- Date student provided official notification of intent to withdraw, in writing or orally.

- The date the student began the withdrawal from Vogue College, records. A student may rescind his/her notification in writing and continue the program. If the student subsequently drops, the student’s withdrawal date is the original date of notification of intent to withdraw.

Upon receipt of the official withdrawal information, Vogue College, will complete the following:

- Determine the student’s last date of attendance as of the last recorded date of academic attendance on the Vogue College’s attendance record;

- Two calculations are performed:

- a. The students’ ledger card and attendance record are reviewed to determine the

calculation of Return of Title IV, HEA funds the student has earned, and if any, the amount of Title IV, HEA funds for which Vogue College is responsible. Returns made to the Federal Funds Account are calculated using the Department’s Return of Title IV, HEA Funds Worksheets, scheduled attendance and are based upon the Payment period. - b. Calculate the Vogue College’s refund requirement (see Institutional Refund Policy):

- a. The students’ ledger card and attendance record are reviewed to determine the

- The student’s grade record will be updated to reflect his/her final grade.

- Vogue College, will return the amount for any unearned portion of the Title IV, HEA funds for which Vogue College is responsible within 45 days of the date the official notice was provided.

- The will provide the student with a letter explaining the Title IV, HEA requirements:

- a. The amount of Title IV, HEA assistance the student has earned. This amount is based upon the length of time the student was enrolled in the program based on scheduled attendance and the amount of funds the student received.

- b. Any returns that will be made to the Title IV, HEA Federal program on the student’s behalf as a result of exiting the program. If the students scheduled attendance is more than 60% of the payment period, he/she is considered to have earned 100% of the Federal funds received for the payment period. In this case, no funds need to be returned to the Federal funds.

- c. Advise the student of the amount of unearned Federal funds and tuition and fees that the student must return, if applicable.

- Supply the student with ledger card record noting outstanding balance due to Vogue College and the available methods of payment. A copy of the completed worksheet, check, letter and final ledger card will be kept in the student’s file.

In the event a student decides to rescind his or her official notification to withdraw, the student must provide a signed and dated written statement that he/she is continuing his or her program of study, and intends to complete the payment period. Title IV, HEA assistance will continue as originally planned. If the student subsequently fails to attend or ceases attendance without completing the payment period, the student’s withdrawal date is the original date of notification of intent to withdraw.

In the event that Vogue College unofficially withdraws a student from Vogue College, the school must complete the Withdrawal Form using the last date of attendance as the drop date.

Any student that does not provide official notification of his or her intent to withdraw and is absent for more than 14 consecutive calendar days, will be subject to termination and considered to have unofficially withdrawn.

Within one week of the student’s last date of academic attendance, the following procedures will take place:

- The education office will make three attempts to notify the student regarding his/her enrollment status;

- Determine and record the student’s last date of attendance as the last recorded date of academic attendance on the attendance record;

- The student’s withdrawal date is determined as the date the day after 14 consecutive calendar days of absence;

- Notify the student in writing of their failure to contact Vogue College, and attendance status resulting in the current termination of enrollment;

- Vogue College, calculates the amount of Federal funds the student has earned, and, if any, the amount of Federal funds for which Vogue College is responsible.

- Calculate the Vogue College’s refund requirement (see Institutional Refund Policy);

- Vogue College, Executive Financial Director will return to the Federal fund programs any unearned portion of Title IV, HEA funds for which Vogue College is responsible within 45 days of the date the withdrawal determination was made and note return on the student’s ledger card.

- If applicable, Vogue College, will provide the student with a refund letter explaining Title IV, HEA requirements:

- a) The amount of Title IV, HEA aid the student has earned based upon the length of time the student was enrolled and scheduled to attend in the program and the amount of aid the student received.

- b) Advise the student in writing of the amount of unearned Title IV, HEA aid and tuition and fees that he/she must return, if applicable.

- c) Supply the student with a final student ledger card showing outstanding balance due Vogue College and the available methods of payment.

- A copy of the completed worksheet, check, letter, and final ledger card will be kept

in the student’s file.

There are some Title IV, HEA funds that you were scheduled to receive that cannot be disbursed to you once you withdraw because of other eligibility requirements. For example, if you are a first-time, first-year undergraduate student and you have not completed the first 30 days of your program before you withdraw, you will not receive any Direct Loan funds that you would have received had you remained enrolled past the 30th day.

Title IV, HEA funds are earned in a prorated manner on a per diem based on scheduled clock hour’s basis up to the 60% point in the payment period. Title IV, HEA aid is viewed as 100% earned after that point in time. Vogue College is required to determine the earned and unearned Title IV, HEA aid as of the date the Student ceased attendance based on the amount of time the Student was scheduled to be in attendance during the payment period. A copy of the worksheet used for this calculation can be requested from the Financial Aid Director.

The institution must perform a R2T4 calculation to determine the amount of earned aid through the 60% point in each payment period or period of enrollment. The institution will use the Department of Education’s prorate schedule to determine the amount of the R2T4 funds the student has earned at the time of withdraw.

After the 60% point in the payment period or period of enrollment, a student has earned 100% of the Title IV, HEA funds he or she was scheduled to receive during this period. The institution must still perform a R2T4 to determine the amount of aid that the student has earned. Vogue College measures progress in Clock Hours, and uses the payment period for the period of calculation.

Determine the amount of Title IV, HEA aid that was disbursed plus Title IV, HEA aid that could have been disbursed.

Calculate the percentage of Title IV, HEA aid earned:

HOURS SCHEDULED TO COMPLETE

TOTAL HOURS IN PERIOD = % EARNED

b) If this percentage is greater than 60%, the student earns 100%.

c) If this percent is less than or equal to 60%, proceeds with calculation.

Percentage earned from (multiplied by) Total aid disbursed, or could have been disbursed = AMOUNT STUDENT EARNED.

Subtract the Title IV, HEA aid earned from the total disbursed = AMOUNT TO BE RETURNED.

100% minus percent earned = UNEARNED PERCENT

Unearned percent (multiplied by) total institutional charges for the period = AMOUNT DUE FROM THE SCHOOL.

- If the percent of Title IV, HEA aid disbursed is greater than the percent unearned (multiplied by) institutional charges for the period, the amount disbursed will be used in place of the percent unearned.

- If the percent unearned (multiplied by) institutional charges for the period are less than the amount due from Vogue College, the student must return or repay one-half of the remaining unearned Federal Pell Grant.

- Student is not required to return the overpayment if this amount is equal to or less than 50% of the total Grant assistance that was disbursed /or could have been disbursed. The Student is also not required to return an overpayment if the amount is $50 or less.

- Vogue College will issue a Grant overpayment notice to Student within 30 days from the date Vogue College’s determination that Student withdrew, giving Student 45 days to either: Repay the overpayment in full to Vogue College or, sign a repayment agreement with the U.S. Department of Education.

Vogue College is authorized to return any excess funds after applying them to current outstanding Cost of Attendance (COA) charges. A copy of the Institutional R2T4 work sheet performed on your behalf is available through the Financial Aid office upon student request.

In accordance with Federal regulations, when Title IV, HEA financial aid is involved, the calculated amount of the R2T4 Funds” is allocated in the following order:

- Unsubsidized Direct Stafford loans (other than PLUS loans)

- Subsidized Direct Stafford loans

- Parent Plus loans – received on behalf of the student

- Direct PLUS loans — received on behalf of the student

- Federal Pell Grants for which a Return is required

- Iraq and Afghanistan Service Grant for which a Return is required

- Other Title IV, HEA assistance

Vogue College must return the amount of Title IV, HEA funds for which it is responsible as soon as possible

but no later than 45 days after it determines or should have determined that the student withdrew.

If you did not receive all the funds that you earned, you may be due a post-withdrawal disbursement. If your post-withdrawal disbursement includes loan funds, Vogue College must get your permission before it can disburse them. You may choose to decline some or all the loan funds so that you don’t incur additional debt. Vogue College may automatically use all or a portion of your post-withdrawal disbursement of grant funds for tuition, fees (as contracted with Vogue College).

Vogue College needs your permission to use the post-withdrawal grant disbursement for all other school charges. If you do not give your permission (some schools ask for this when you enroll), you will be offered the funds. However, it may be in your best interest to allow the school to keep the funds to reduce your debt at Vogue College.

Vogue College must offer any post-withdrawal disbursement of loan funds within 30 days of the date the Vogue College determined the student withdrew. Vogue College must always return any unearned Title IV, HEA funds it is responsible for returning within 45 days of the date Vogue College determined the student withdrew.

- Vogue College must disburse any Title IV, HEA grant funds a student is due as part of a post-withdrawal disbursement within 45 days of the date Vogue College determined the student withdrew and disburse any loan funds a student accepts within 180 days of the date Vogue College determined the student withdrew. But no later than 90 days from the date Vogue College determined the Student withdrew for loans, and no later than 45 days from the date Vogue College determined the Student withdrew for Grants.

- However, if the Student (or parent in the case of a PLUS loan) is eligible to receive a post-withdrawal disbursement of loan funds, the Student or parent borrower must first confirm in writing whether he/she accepts/declines all or some of the loan funds offered as a post-withdrawal disbursement.

- A post-withdrawal disbursement of Federal Grant funds does not require Student acceptance or approval and the Grant funds may be applied directly to the Student’s account to satisfy tuition and fees, or to the Student.

Any amount of unearned Grant funds that a Student must return directly is called an overpayment. The amount of a Grant overpayment that the student must repay is half of the Grant funds received or scheduled to receive. The student must make arrangements with Vogue College and/or the Department of Education to return the unearned Grant funds failure to do so will result in no additional Title IV, HEA aid.

If enrollment is temporarily interrupted for a Leave of Absence (LOA), the Student will return to Vogue College in the same progress status as prior to the LOA. Hours elapsed during a LOA will extend the Student’s contract period by the same number of days taken in the LOA and will not be included in the Student’s cumulative attendance percentage calculation. Students who fail to return from an LOA will have an Unofficial Withdrawal on the date they were scheduled to return from the LOA. This date will be used for the Cancellation & Refund Policy and RT24 calculations.

If Vogue College attempts to disburse the credit balance by check and the check is not cashed, Vogue College must return the funds no later than 240 days after the date Vogue College issued the check.

If a check is returned to Vogue College or an EFT is rejected, Vogue College may make additional attempts to disburse the funds, if those attempts are made not later than 45 days after the funds were returned or rejected. When a check is returned or EFT is rejected and Vogue College does not make another attempt to disburse the funds, the funds must be returned before the end of the initial 45-day period.

Vogue College must cease all attempts to disburse the funds and return them no later than 240 days after the date it issued the first check.

Vogue College’s responsibilities in regards to Title IV, HEA funds follow:

- Providing students information with information in this policy;

- Identifying students who are affected by this policy and completing the return of Title IV, HEA funds calculation for those students;

- Returning any Title IV, HEA funds due to the correct Title IV, HEA programs.

The institution is not always required to return all the excess funds; there are situations once the R2T4 calculations have been completed in which the student must return the unearned aid.

Any amount of unearned grant funds that you must return is called overpayment. The amount of grant overpayment that you must repay is half of the grant funds you received or were scheduled to receive. You must make arrangement with Vogue College or Department of Education to return the amount of unearned grant funds.

- Returning to the Title IV, HEA programs any funds that were dispersed to the student in which the student was determined to be ineligible for via the R2T4 calculation.

- Any notification of withdraw should be in writing and addressed to the appropriate institutional official.

- A student may rescind his or her notification of intent to withdraw. Submissions of intent to rescind a withdraw notice must be filed in writing.

- Either these notifications, to withdraw or rescind to withdraw must be made to the official records/registration personal at your Vogue College.

The requirements for the Title IV, HEA program funds when you withdraw are separate from any refund policy that Vogue College may have to return to you due to a cash credit balance. Therefore, you may still owe funds to Vogue College to cover unpaid institutional charges. Vogue College may also charge you for any Title IV, HEA program funds that they were required to return on your behalf.

If you do not already know what the Vogue College refund policy is, you may ask the Financial Aid office or refer to the Institutional Refund Policy in this catalog.

Return to Title IV, HEA questions?

If you have questions regarding Title IV, HEA program funds after visiting with your financial aid director, you may call the Federal Student Aid Information Center at 1-800-4-fedaid (800-433-3243). TTY users may call 800-730-8913. Information is also available on student aid on the web www.studentaid.ed.gov.

*This policy is subject to change at any time, and without prior notice.

Exit counseling

A student Direct Loan borrower who is graduating, leaving school, or dropping below half-time enrollment is required to complete exit counseling. If the borrower drops out without notifying your school, you must confirm that s/he has completed online counseling or mail exit counseling material to him at his/her last known address. It is also acceptable to email the information to his/her home (not school) email address if you have it. The print or PDF version of the Exit Counseling Guide for Federal Student Loan Borrowers satisfies this requirement. Whatever material you use, you must mail or email it within 30 days of learning that the borrower has withdrawn or failed to participate in an exit counseling session.

When mailing exit materials to students who have left school, you’re not required to use certified mail with a return receipt requested, but you must document in their file that the materials were sent. If they fail to provide updated contact information, you are not required to take further action.

FINANCIAL AID CONSUMER INFORMATION

TITLE IV ELIGIBILITY

In order to determine eligibility for Title IV Funds, Students must:

- Complete a current year FAFSA and submit with proper school code Be enrolled in a Title IV eligible course at Vogue College

- Comply with our Satisfactory Academic Progress (SAP) policy included in the School’s catalog. See SAP policy

- Not be in default on a loan made under any Title IV, HEA Loan program

- Must not have obtained loan amounts that exceed annual or aggregate loan limits under any Title IV, HEA Loan program.

- Not be liable for any grant or loan overpayment

- Possess a verifiable Social Security Number.

- Meet citizenship and residency requirements as follows:

(i) Be a citizen or national of the United States, which includes Puerto Rico (on or after January 13, 1941), Guam, the U.S. Virgin Islands (on or after January 17, 1917), American Samoa, Swains Island, or the Northern Mariana Islands, unless the person was born to foreign diplomats residing in the U.S. or;

(ii) Provide evidence from the U.S. Immigration and Naturalization Service that he or she is a permanent resident of the United States or;

(iii) Is in the United States for other than a temporary purpose with the intention of becoming a citizen or permanent resident; or

(iv) Be a citizen of the Federated States of Micronesia, Republic of the Marshall Islands, or the Republic of Palau.

(v) Is eligible to receive funds under Federal Pell Grant programs.

- Complete Selective Services Registration:

To be eligible to receive Title IV, HEA program funds, a male Student who is subject to registration with the Selective Service must register with the Selective Service (a male Student does not have to register with the Selective Service if the Student is below the age of 18 or was born before January 1, 1960).

STUDENT CONSUMER FA INFORMATION

Federal Student Disclosure Requirements

Regulations set forth by the U.S. Dept. of Education require the disclosure of financial assistance and institutional information to students under Title IV of the Higher Education Act of 1965. These programs include the Federal Pell Grant Program, the campus-based programs (Federal Perkins Loan, Federal Work-Study (FWS), and Federal Supplemental Educational Opportunity Grant (FSEOG) programs), the William D. Ford Federal Direct Loan (Direct Loan) Program, and the Federal Family Education Loan (FFEL) Program. Under the regulations, Vogue College of Cosmetology will notify enrolled students of the Title IV programs available to them.

STUDENT FINANCIAL ASSISTANCE AVAILABLE

The following student financial assistance is available at Vogue College of Cosmetology for those who qualify:

- Federal Direct Stafford Loans

- Federal Direct Parent PLUS loans

- Federal Pell Grant

VERIFICATION POLICY

It is the policy of Vogue that only those students selected by the Dept. of Education will be required to comply with the verification process. The student’s FAFSA will be flagged with a verification number that will determine what information will need to be verified and what verification form to use. Please contact the financial aid office for more information. There is a $0 verification tolerance, all discrepancies must be corrected.

ATB POLICY

Effective July 1, 2012 Ability-to-Benefit Students will no longer be eligible for Title IV Federal Financial Aid if they are first time borrowers. ATB students enrolled in approved programs of study after July 1, 2012 with prior federal student loan balances, however, will be grandfathered in and will remain Title IV eligible.

DISBURSING FEDERAL AID

Federal Pell Grants

Pell Grants are disbursed in two payments per award year. The first disbursement generally occurs during the first week of enrollment, and the second disbursement occurs after the students complete the halfway point of their academic year. This is typically 450 clock hours for the Cosmetology program, 375 for the Esthetics

and Instructor programs, and 300 for the Nail Technology program, provided the student is maintaining Satisfactory Academic Progress. A full-time Cosmetology student attending 34 hours per week, for example, will need to complete a minimum of 13 weeks and 450 clock hours before receiving payment period 2 funds. A

part-time Esthetics student attending 24 hours per week will need to complete a minimum of 16 weeks and 375 hours. Pell awards are prorated based on clock hours and COA.

Federal Direct Stafford Loans

Stafford Loans are also disbursed in two payments per award year. The first disbursement takes place after 30 calendar days after enrollment*, and the second disbursement occurs after the student completes the halfway point of their academic year. This is also generally at 450 clock hours for the Cosmetology program, 375 for the Esthetics and Instructor programs and 300 clock hours for the Nail Tech program, provided the student is maintaining Satisfactory Academic Progress. Hours and weeks must be met prior to disbursement.

Federal Direct Parent Loan (PLUS)

The Parent PLUS Loan is disbursed in two payments per academic year as well. The first disbursement takes place after 30 calendar days of enrollment*, and the second disbursement occurs after the student completes

the hallway point of their academic year, both hours and weeks, provided the student is maintaining Satisfactory Academic Progress.

*Vogue College may make first disbursement prior to 30 calendar days of enrollment if the student is not a first year, first time borrower, and has a current federal student loan balance. Students who borrow a Stafford Direct Loan while attending Vogue College must complete the Direct Loan Entrance Counseling and an electronic master promissory note before funds will be certified.

Need Based Aid (Pell Grant and Stafford Subsidized Direct Loan)

Calculation:

COA (Cost of Attendance) – EFC (Expected Family Contribution) = Need Eligibility

Non-Need Based Aid (Unsubsidized Stafford and Parent PLUS Loan)

Must not exceed COA with all aid combined

COA = Budget – each Student receiving an Award Letter estimating Title IV Eligibility will be assigned a Budget. The COA includes the following items: Tuition & Fees, Room and Board, Loan fees, Transportation, Misc/Personal, Books/Supplies and Other items such as special expenses related to disabilities may be added.

COA BUDGETS

Estimated by the U.S. City Average consumer price index:

Room and Board – $412 Per Month – Dependent Student living at home

Room and Board – $804 Per Month – Off Campus

Personal Expenses – $241 Per Month

Transportation Expenses – $156 Per Month

LEAVE OF ABSENCE (LOA) WHILE ON FINANCIAL AID

For Federal Aid recipients, the student’s payment period is suspended during the LOA and no federal student loans will be disbursed to students while on an LOA. Upon the student’s return, they will resume the same payment period and clock hours, and will not be eligible for an additional Title IV disbursement until the next payment period has been reached by both hours and weeks. If the student is a Title IV loan recipient, the student will be informed of the effects that the student’s failure to return from a leave may have on their loan repayment terms, including the expiration of the student’s grace period.

RETURN TO TITLE IV (R2T4) POLICY

This policy applies to all recipients of Federal Title IV Aid. Students that are no longer attending the School may still owe funds to the School to cover unpaid tuition. Additionally, the School may attempt to collect any funds from a Student that the School was required to return as a result of this policy. The School is required to calculate how much Federal Aid may be retained or refunded on behalf of the Student who withdraws. The calculated amount is referred to as “Return of Title IV Funds” (R2T4). The calculation of Title IV funds earned by the Student has no relationship to the Student’s tuition and fees that may be owed to the School. The School has 45 days from the date the School determines the Student withdrew to return all unearned funds for which it is responsible. The School will notify the Student in writing of the amount of funds that must be returned. If a student provides all documents required for verification after withdrawing and in time for the institution to meet the 30-day Return deadline, Vogue will perform the R2T4 including all Title IV aid for which the student has established eligibility.

WITHDRAWAL AT OR BEFORE 60%

The School must perform a R2T4 to determine the amount of earned aid up through the 60% point in each payment period and use the Department of Education’s formula to determine the amount of R2T4 funds the Student has earned at the time of withdrawal. A R2T4 will be due for anyone scheduled at 60% or less of their payment period.

WITHDRAWAL AFTER 60%

For a Student who withdraws after the 60% of their payment period, there are no unearned funds. The Student has earned 100% of the Title IV funds he or she was scheduled to receive during that payment period. The School will still calculate eligibility for a post-withdrawal disbursement.

CALCULATING R2T4

Title IV funds are earned with scheduled clock hours. Title IV aid is viewed as 100% earned after the student is scheduled over 60% of their payment period. The School is required to determine the earned and unearned Title IV aid as of the last date of attendance. In accordance with federal regulations, when Title IV financial aid is involved, the calculated amount of the R2T4 Funds is allocated in the following order: Unsubsidized Direct Loans, Subsidized Direct Loans, Direct PLUS loans followed by Federal Pell Grants. The calculation steps are outlined in the following example:

- Calculate the percentage of Title IV aid earned:

a) Divide the number of clock hours scheduled to be completed in the payment period as of the last date of attendance in the payment period by the total clock hours in the payment period.

HOURS SCHEDULED TO COMPLETE

TOTAL HOURS IN PERIOD = % EARNED

b) If this percentage is greater than 60%, the Student earns 100%.

c) If this percent is less than or equal to 60%, proceed with calculation as follows: - Percentage earned from (multiplied by) Total aid disbursed, or could have been disbursed = AMOUNT STUDENT EARNED.

- Subtract the Title IV aid earned from the total disbursed = AMOUNT TO BE RETURNED.

- 100% minus percent earned = UNEARNED PERCENT

- Unearned percent (multiplied by) total institutional charges for the period = AMOUNT DUE FROM THE SCHOOL.

- If the percent of Title IV aid disbursed is greater than the percent unearned (multiplied by) institutional charges for the period, the amount disbursed will be used in place of the percent unearned.

- If the percent unearned (multiplied by) institutional charges for the period are less than the amount due from the School, the Student must return or repay one-half of the remaining unearned Federal Pell Grant.

- Student is not required to return the overpayment if this amount is equal to or less than 50% of the total Grant assistance that was disbursed /or could have been disbursed. The Student is also not required to return an overpayment if the amount is $50 or less.

- School will issue a Grant overpayment notice to Student within 30 days from the date the School’s determination that Student withdrew, giving Student 45 days to either: Repay the overpayment in full to the School or, sign a repayment agreement with the U.S. Department of Education.

Exit Counseling is required for all students who borrow federal student loans while attending Vogue and withdraw. If a Student is unavailable to complete this information in person, the Direct Loan Exit Counseling link will be e-mailed to them for completion within 30 day of the date the school determined.

POST WITHDRAWAL DISBURSEMENT (PWD) POLICY

Vogue will offer any post-withdrawal disbursement of loan funds in writing within 30 days of the date of the school’s determination that the student withdrew. If a response is received by the student or parent within 30 days that allows the school to make all or a portion of the post-withdrawal disbursement, Vogue will disburse the funds within 180 days of the date of determination.

The school must disburse any Title IV Pell grant funds a student is due as part of a post-withdrawal disbursement within 45 days of the date the school determined the student withdrew and disburse any loan funds a student accepts within 180 days of the date the school determined the student withdrew. Title IV funds not subject to verification apply.

NSLDS (National Student Loan Data System) is available at www.nslds.ed.gov where borrower’s loan history can be reviewed. You may also contact them directly at 1-800-4-FED-AID The Ombudsman’s Office (1-877-557-2575) is a resource for borrowers when other approaches to resolving Student loan problems have failed.

TITLE IX

SEXUAL HARASSMENT AND SEXUAL VIOLENCE POLICY

VCC Management, LLC (“Vogue College”), d/b/a Vogue College , is committed to providing a safe educational environment which is free of violence, harassment and discrimination. Therefore, in accordance with Title IX of the Education Amendments of 1972 and the Jeanne Clery Disclosure of Campus Security Policy and Campus Crime Statistics Act (“Clery Act”), along with its amendments made pursuant to the Violence Against Women Reauthorization Act of 2013 (“VAWA”), Vogue College has adopted strict policies regarding these matters.

Notice of Non-Discrimination

Consistent with Title IX of the Education Amendments of 1972, Vogue College of Cosmetology does not discriminate against students, faculty or staff on the basis of race, color, national origin, sex, disability, or age in any of its programs or activities, including but not limited to educational programs, employment, and admission. Sexual harassment, including sexual violence, is a kind of sex discrimination and is prohibited by Title IX and by the College.Vogue admits students of any race, color, national and ethnic origin or other protected characteristics to all rights, privileges, programs and activities generally made available to students, and is non-discriminatory in its administration of educational policies, scholarship and loan programs, and other school-administered programs.

Vogue College of Cosmetology Title IX Policy and Procedure

Institutional Commitment

Vogue College of Cosmetology is committed to maintaining a learning environment that is free from inappropriate conduct based on sex. It is Vogue’s policy to provide an educational and working environment for its students and staff that is free of sexual discrimination. Sexual discrimination, which includes sexual harassment and/or sexual violence, will not be tolerated, and individuals who engage in such conduct will be subject to disciplinary action. Any student, member of the faculty or staff, a campus visitor or contractor, is encouraged to immediately file a complaint.

Reports of sexual discrimination, which includes sexual harassment and/or sexual violence, can be made to the institution at any time. Individuals are encouraged to report such incidents as soon as possible after the date of the alleged incident so prompt action can be taken to investigate and resolve the complaint. No person is required to report sexual harassment to the alleged offender.

Where to Report

A complaint may be filed with the Title IX Coordinator in person, by mail, by email or by any other means that results in the Title IX Coordinator receiving the Complainant’s verbal or written report. Reports of sexual discrimination, to include sexual harassment and/or sexual violence, can be made at any time including during non-business hours.The College encourages individuals to report such incidents as soon as possible after the date of the alleged incident so prompt action can be taken. The Title IX Coordinator must promptly contact the Complainant confidentially to discuss the availability of supportive measures, consider the Complainant’s wishes with respect to supportive measures with or without the filing of a Formal Complaint, and explain to the complainant the process for filing a Formal Complaint.

How to Report

A Formal Complaint is made by the written submission of complete documentation of an alleged incident of sexual discrimination, to include sexual harassment and/or sexual violence, to the Title IX Coordinator.

The documentation must include:

- Date and time of alleged incident;

- Location and names of individuals involved in the alleged incident;

- Specific details of what happened and resulting effects related to the incident;

- Names of any witnesses to alleged incident;

- Any action taken following the incident;

- A physical or digital signature of the Complainant.

Note: No Formal Complaint may be filed anonymously. The grievance process requires that the Complainant’s identity must be disclosed to the Respondent.

Title IX Coordinator

The Title IX Coordinator has the authority to oversee the grievance process and ensure that equitable, non-biased treatment of all parties. The Title IX Coordinator must not have a conflict of interest or bias toward either the Complainant or the Respondent.

The Title IX Coordinators are as follows:

Home Office

Roxanne Garza

Financial Director of Operations

Vogue College of Cosmetology

1101 S. Capitol of Tx Hwy, Building K, Suite 150

Austin, TX 78746

512-916-0077 Ext 1100

[email protected]

Fredericksburg

Sylvia Perez

School Director

1836 Fredericksburg Rd.

San Antonio, TX 78201

210-735-9401

[email protected]

Ingram

Lymarie Marcano

Financial Aid

6012 Ingram Rd.

San Antonio, TX 78238

210-432-5904

[email protected]

McAllen

Susana Gonzalez

School Director

800 W. Fern Ave.

McAllen, TX 78501

956-687-6149

[email protected]

Lubbock

Christin Delarosa

Financial Aid

1712 34th St.

Lubbock, TX 79411

806-589-5150

[email protected]

Santa Fe, NM

Laura Bencomo

Financial Aid

2434 Cerrillos Road

Santa Fe, NM 87505

505-473-5552

[email protected]

Complaints of sexual discrimination, to include sexual harassment and/or sexual violence, involving non-students will be guided by the College’s Title IX Coordinator at the Home Office.

Students may also contact the U.S. Department of Education, Office for Civil Rights (OCR) to complain of sex discrimination or sexual harassment including sexual violence.

http://www.hhs.gov/ocr/civilrights/complaints/index.html

Retaliation Prohibited

No Student or employee will retaliate in any way against an individual who, in good faith, has brought a Formal Complaint pursuant to this policy or participated in an investigation of such a Formal Complaint. Any person who violates this provision may be subject to discipline, and up to and including termination of employment or dismissal from the College.

Counseling and Health Services

The services listed below are available to victims regardless of whether or not he/she chooses to report the incident to law enforcement:

- Sexual Assault Legal Service – 888-343-4412

- Texas Association Against Sexual Assault http://taasa/org or at 512-474-7190

- Solace Crisis Treatment Center https://www.findsolace.org/ 505-988-1951

Training

All Vogue employees receive annual Title IX Training. The Title IX Coordinators, Investigators, and Decision-Makers receive training annually specific to their role in the Title IX process.

Listed below are all materials used to train Title IX Coordinators, Investigators, Decision-Makers, and any person who facilitates an informal resolution process.

Coordinators, Investigator and Decision-maker

- Overview of Title IX and VAWA

- Reporting and Response

- Investigations and Disciplinary Procedures

- Prevention and Education

Training Course

Title IX and VAWA Training: Building Safer Campuses

The training course, provided by the Accrediting Commission of Career Schools and Colleges (ACCSC) is “designed to assist personnel at all levels of an educational institution in the understanding of the provisions of Title IX of the Education Amendments of 1972 (“Title IX”), and the Clery Act as it was amended in the Violence Against Women Reauthorization Act of 2013. (“VAWA”).” Additionally, the “course gives the participants information about the laws, as well as procedures to follow, to provide for the rights of all individuals under the laws.”

Testimonials

Professional Affiliations

Texas Department of Licensing and Regulation may be contacted at www.tdlr.texas.gov

Fredericksburg Campus

1836 Fredericksburg Rd.

San Antonio, TX 78201

Admissions: 1 (866) 227-3779

Salon & Spa: 1 (210) 735-9401

Financial Aid: 1 (210) 735-9401

Ingram Road

6012 Ingram Road

San Antonio, TX 78238

Admissions: 1 (866) 227-3779

Salon & Spa: 1 (210) 432-5904

McAllen

800 W Fern Ave.

McAllen, TX 78501

Admissions: 1 (866) 227-3779

Salon & Spa: 1 (956) 687-6149

Financial Aid: 1 (956) 687-6149

Lubbock

1712 34th Street

Lubbock, TX 79411

Admissions: 1 (866) 227-3779

Salon & Spa: 1 (806) 589-5150

Financial Aid: 1 (806) 589-5150

Santa Fe

2434 Cerillos Road

Santa Fe, NM 87505

Admissions: 1 (866) 227-3779

Salon & Spa: 1 (505) 473-5552

Financial Aid: 1 (505) 473-5552

© 2022 Vogue College of Cosmetology. All Rights Reserved. Privacy Policy